Discover more from Communiqué

Communiqué 09: Spotify comes to Nigeria. So what?

Spotify is expanding globally and has officially launched in Nigeria. This comes with several potential opportunities that transcend music streaming.

On February 23, 2021, I finally downloaded Spotify onto my phone. For four years, I’d been confined to using the service on my laptop with a VPN. Anyone who’s had to do this knows how annoying it can be. Sometimes the app logs you out, and signing back in can be a hassle. Not anymore.

Spotify’s expansion into 85 new countries means it is now readily available in Nigeria, Ghana, and Kenya. It enters an already crowded Nigerian market with Apple Music, Boomplay, Deezer, Gbedu, UduX, and music blogs where users can stream/download music for free. It also has to contend with Beat FM, Cool FM, and other radio stations that regularly play music (radio remains the biggest medium in Nigeria). So, the economics aren’t attractive enough for it in Nigeria, but only as an isolated market. Globally, however, the expansion makes absolute sense.

If you think about Spotify purely as a music streaming service, I can excuse you for failing to see why its entry into the market is a big deal. Beyond user experience (which is a technicality), there’s not much else to it. It operates a freemium model, and its cheapest subscription plan is N900. It costs the same as an Apple Music subscription and N400 more than Boomplay. But this goes past just another music streaming platform entering into the market.

Spotify’s real gameplan is owning your passive media experience via audio. It is gunning for the whole nine yards—music, podcasts, audio advertising, audiobooks, and whatever else technology can conjure.

Here’s what Spotify CEO, Daniel Ek, realised in 2019:

“More than 10 years ago, we founded Spotify to give consumers something they couldn’t get — music any time, anywhere, and at the right price… I’m proud of what we’ve accomplished, but what I didn’t know when we launched to consumers in 2008 was that audio — not just music — would be the future of Spotify… With the world focused on trying to reduce screen time, it opens up a massive audio opportunity. This opportunity starts with the next phase of growth in audio — podcasting.”

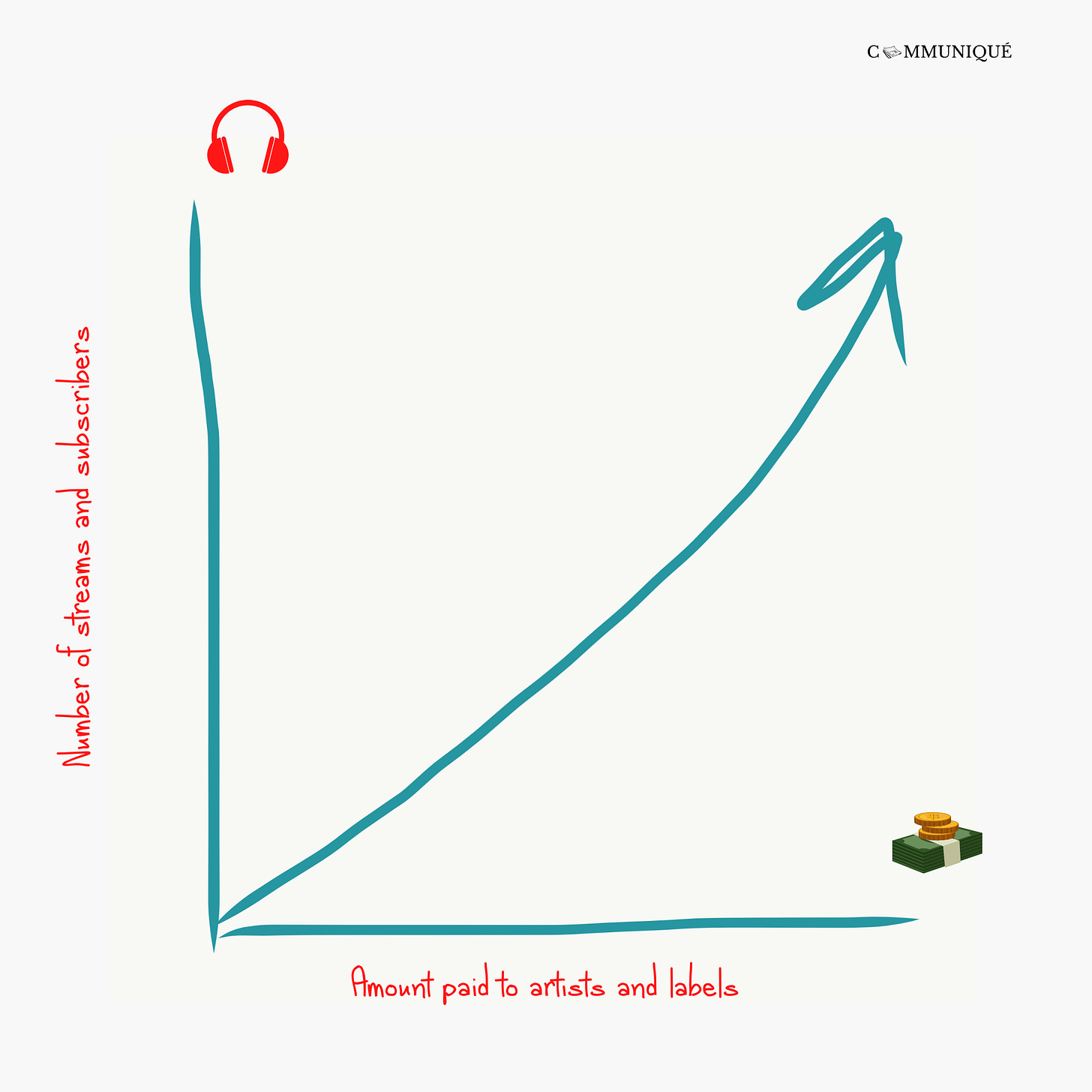

Music streaming is a cruel business. The bigger a platform grows, with more subscribers and streams, the more money it has to lose by paying artists, distributors, and record companies. For Spotify, this comes out of its net revenue from adverts and subscription fees.

Rolling Stone reports that Spotify pays record companies 52% of all profits from their artists’ streams, and a further 10-15% of its revenue goes to songwriters and music publishers. For Spotify to continue growing, it needs to add content to its platform that it doesn’t have to pay for perpetually. This is where podcasts and other audio forms come in.

Since 2013, it has acquired 19 companies that provide services ranging from podcasting to music discovery, music intelligence, and cloud computing. It spent $600 million on acquisitions related to podcasting between February 2019 and 2020 alone. It is exploring audiobooks as well.

Why is Spotify only just expanding to these markets?

According to Morning Brew, “Spotify has been slower to expand outside the US and Europe because securing music rights is a huge headache... [Its recent] expansion [now opens] its service up to 1 billion more people, which will help power discoverability for new artists, styles, and genres.”

Its expansion also taps into the growing success of international content. The South Korean movie, Parasite, won Best Picture at the 2020 Oscars. It was the first-ever foreign-language film to do so, but its win was not “the beginning of something new”. It was indicative of what has since been brewing. Hollywood seems to be out of ideas, reflected both in its obsession with remakes and sequels and the audience’s hunger for more international content on streaming platforms. Toby Howell of Morning Brew writes, “[T]he US has historically dominated the music and entertainment industries. But the growing success of international content shows the centre of gravity is shifting.”

With increased competition in the streaming landscape, small margins could contribute to massive gains. Netflix saw this with the international expansion that brought it into Nigeria. Now, Spotify is going down that route, using the same playbook.

A quick reminder to subscribe if you haven’t already, so you don’t miss out on any edition.

What are the opportunities?

Two interesting pieces of Spotify’s expansion puzzle are:

Its commitment to work “closely with local creators and partners in each market”. I imagine that it will initially do this in Nigeria with musicians and record labels; they are the lowest-hanging fruit.

Its long-term plan to help creators monetise their content. This is something Ek expects to play out over the next decade as radio fades and audio content moves from linear to on-demand.

As we already established, Spotify’s gameplan transcends music streaming. While music is great for attracting users and subscribers, music streaming is a cruel business, and audio will play a larger role in the future of media. So, podcasts, audio advertising, audiobooks, audio branding, voice, etc., all constitute vital parts of its strategy. This is where the long-term opportunities lie for the Nigerian (and African) creative industry.

While Spotify isn’t precisely focusing on African markets, its expansion still opens up some exciting opportunities. For example, there could also be room for audio technology services that help Spotify (and other services like it) figure out how to better engage its content with African audiences. Perhaps there is room for audio podcast networks that help Spotify aggregate content, the way FilmOne does for Netflix in Nigeria. Or maybe there is room for audiobooks and audio dramatisations of African literary classics.

In another case, suppose the Loose Talk podcast was still running with the level of conversations each episode generated and its impact on Nigerian pop culture. In that case, there could have been a potential licensing deal on the horizon, not unlike Joe Rogan’s. That said, Loose Talk’s success proves a gap in the market, but any takers must look beyond the boundaries of Nigeria and appeal to international audiences. Because although Nigeria is populous, its economy does not have the stamina to match the value of its creative industry. This large audience does not have the spending power to push content to its full potential. And it is the possibility of tapping into vast but buoyant audiences that will make any service like Spotify pay greater attention to an ecosystem.

The snags

There is a caveat, though. Unlike Netflix, which came into the market to leverage local content with a global appeal and tap into an already mature ecosystem, Spotify can’t yet do the same. Where Netflix could work with an established pool of actors, directors, scriptwriters, and production companies moving towards a centralised goal, Spotify can’t yet do the same.

Away from music, the audio content ecosystem has not reached the point where it can attract comparable investments, except in radio. Podcasting remains relatively small, audio advertising is largely limited to radio, audio ad-tech is almost nonexistent, and audiobooks are still not widely adopted. Then there is the content direction snag. Because the ecosystem is far from maturity, there isn’t much local audio content with global appeal, and so there are no windfalls in sight.

However, there is already talent and infrastructure to create audio content that could interest platforms like Spotify. But most of them are either devoted to radio or scattered across several industries—presenters, voice-over artists, sound engineers, scriptwriters, audio producers, data analysts, etc. What we need is convergence, and only the right incentives can drive this.

Business ecosystems thrive on incentives. For example, the technology ecosystem is driven by the promise of wealth and the many ways innovation can lead to it. The entertainment industry promises fame and fortune, and harvesting people’s attention through music and film creates a pathway. These ecosystems are bigger now than they were many years ago because of investments fuelled by compelling incentives.

Audio will play a much bigger role in the future of media as people continue to experience screen fatigue. The journey to the point where Spotify’s expansion brings tangible opportunities to African creatives is long and arduous. But there is a journey still, and there are incentives. I don’t see a better signal than when “the world’s most popular audio streaming subscription service” begins a venture into your market.

(PS: A big thank you to my friend, Hassan Yahaya, for helping me refine the arguments in this essay.)

Additional reading

Spotify CEO explains how the company plans to help artists (and itself) make money - The Verge

Spotify debuts new tools for creators to make interactive podcasts - Axios

Spotify has tripled number of podcasts in past year to 2.2 million - Axios

How much does Spotify pay per stream? - Business Insider

One more thing…

I’ve been writing Communiqué for over a year now, and each edition requires hours (sometimes days and weeks) of research, thinking, writing, editing, and design. So, if you find the insight that I provide valuable, please do me a favour: like the post and share it directly with at least two people you think will love it.

Also, if you like the quality of work that goes into the newsletter, I offer the same quality of writing, research, and consulting services to corporate clients. Reach out to me and let's talk.

Thank you for reading. If you enjoyed this, please share it with your friends. If you haven’t already, please subscribe:

This is good news for content creators if you ask me. Speaking as an author and book publisher, I am certain that this development can help create a new direction that will help the publishing industry regain its commercial viability.

As usual, you have here a well researched and educative article. Thanks.

I like that you point out that its a long game. The challenge with launching platforms that are digital dependent in Nigeria is that the numbers just aren't there. Potentially, yes. But the conditions that drive digital adoption in Nigeria are almost exclusively economic, and addressing that will take a shit long time. Great read!