Discover more from Communiqué

Communiqué 14: Stears' lemonade machine and Netflix's $3 beer

Stears makes a pivot. Netflix finally drinks Nigerian beer.

One of the biggest challenges of analysing the media ecosystem in Africa is that there aren’t too many innovative media companies to write about.

Don’t get me wrong. Several media companies do great work, but only a tiny subset is innovative and forward-thinking. Only a tiny subset pushes the envelope with technology, business models, content formats, community building, engineering, etc.

I’ve written about some in the past. I wrote about Paystack, a fintech company, executing its content marketing strategy using a media playbook in the last newsletter. In Communiqué 12, I talked about Daily Nation, Kenya’s largest newspaper, examined Multichoice’s subscription strategy, and highlighted Daily Maverick’s membership model. In Communiqué 02, I touched on Premium Times’ decision to integrate crowdfunding into its community-building efforts. Last year, in this newsletter’s maiden edition, I looked at Stears’ decision to go subscription-first and build data analysis and research services.

Coincidentally, Stears is the first subject of today’s newsletter.

Part 1: Stears’s lemonade machine

In ‘Stears’ $600k war chest’, I wrote about the company’s strategy after raising (and announcing) $600,000 in venture capital:

“By choosing not to move with the status quo and [playing] the traditional game of reach and quantity, Stears avoids fighting in a crowded arena. However, it also deprives itself of the media industry’s biggest revenue source, advertising. In Nigeria, advertisers are attracted to page views, and page views are stimulated not only by content quality but by quantity.

To make up for this, Stears is challenging on another similarly competitive stage, but one with potentially higher returns – research and data analysis.”

I was right about two things:

Stears avoids the ruckus that comes with serving a mass audience by shifting from the reach strategy. However, that also means it won’t eat from the advertising cake, which remains the largest revenue source for the media in Africa.

Stears’ focus on research and data analysis puts it in another equally challenging arena with potentially more significant upsides.

However, what I was oblivious to is one of the most crucial factors for understanding what Stears is and what it can be.

Stears is not a media company. (Another way to put it is, Stears is not just a media company.) Instead, it is a technology company that provides products and services, including a media publication (Stears Business) and a research and data analysis service (Stears Data).

Why am I bringing this up now? July 28, 2021, made it exactly one year since the company put its content behind a paywall, an audacious move in this market. You don’t need a genie to tell you how challenging it has been. Here’s what Preston Ideh, the company’s CEO, has to say about the experience so far:

“It has been 365 days since we launched our paywall, and there has been no shortage of worry, anxiety and existential concern… Admittedly, when we launched, we knew very little about what it took to build a successful subscription business. We had no idea we would be fighting so many fires. All we knew was that we were newly minted with venture capital funding, and it was time to disrupt the media industry… Since then, we have learnt a few things. Even now, the more we learn, the more we know we must learn.”

As difficult as it can be to build a subscription-first media product in this market where very few others are doing it, some benefits make the venture worthwhile with the right conditions. One of these benefits is the invaluable experience that opens your eyes to other problems you can solve with new products and services. This can only happen if you have the right people on your team and genuinely understand your business model. As Ben Thompson said, understanding business models is one of the most reliable ways to understand the behaviour of organisations.

When life gives you lemons, build lemonade machines

In ‘The subscription playbook’, I highlight the major challenges of running a subscription business in Africa. The most prominent is the harsh economic realities that squeeze market size. (Simply put, most people are poor and can’t afford to pay subscription fees.) Then I wrote about unfavourable audience behaviour, shortage of talent, competition from free social media services, and the inadequate payment infrastructure. All of these tell part of the story, but there’s more.

Even within the parochial market for subscription services, both the audience willing to pay subscription fees and the platforms that provide such services face infrastructural limitations. Understanding these limitations and seeing where you can potentially alleviate the situation is the textbook definition of innovation. But, how many media companies think to do this in Africa? You know the answer.

For Stears, the challenge lies in getting creative with subscription offerings and reader experience. There are technical problems with subscription management that are, in some ways, unique to African publishers, mainly because it is a nascent concept on the continent and the talent and resources needed to solve them are not readily available. Subscription management requires an incredible amount of engineering investment that most media companies can either not afford or be bothered to make.

Here’s how Ideh explains the problem:

“This infrastructure hurdle [to providing subscription products] can make or break publishers. It might seem negligible when you have only a few subscribers. But at scale, it can become a nightmare.

It gets even more complex when African publishers want to be creative with their reader experiences. For instance, how do you efficiently nudge readers to go from a free trial to a premium plan like the Economist does it? How do you reset your discounted offer from $1 to $20 a month at the end of a promo period the way Bloomberg does? Behind the scenes (and you can ask my team if you do not believe me), it requires engineering power that most media businesses do not have.”

This is what differentiates Stears from many other companies, and this is why it is crucial to think about it as more than just a media company.

Operating as a tech company allows Stears to perceive technical or structural difficulties as business gaps it can bridge with products or services. You can see this positioning as a tech company in its hiring patterns and team structure. And, perhaps, you can tell its positioning as a tech company through its decision to capitalise on the culture of announcing funding rounds.

Knowing this, it makes sense when its CEO announces that the company will receive a grant from the Google News Initiative to build a subscription management service to cure some of the headaches that African publishers face (and will face) as they develop their own subscription products.

The brilliant thing, though, is that this problem of subscription management isn’t limited to publishers alone. There is an entire market for it outside of the media.

Inspired by the success stories of Chargebee, an Indian subscription management platform worth $1.4 billion, and Zuora, which generates over $300 million in annual revenue, Stears is starting where the shoe pinches and gradually expanding from there.

Part 2: Netflix’s $3 beer

In ‘Netflix walks into a Nigerian bar’, I wrote about the company’s strategy for the Nigerian (and African) market:

“Beyond content aggregation and licensing, Netflix is now investing in originals, which brings us to our main point. The goal is not necessarily to grow subscribers here, at least not primarily. It is to expand its content bank with Nigerian content for a global audience. In other words, exposing Nigerian and African content to its more lucrative and potentially lucrative markets. It’s less about African stories for an African audience. There’s very little to indicate that Netflix thinks investing in Nigerian content will mushroom its subscriber base here. What’s more likely is that it will leverage Nigeria’s cultural influence to attract more eyeballs from around the world.”

It’s been over a year, and things have changed. By the end of 2020, Netflix had over 1.9 million subscribers across the continent, up from 1.4 million in Q1 2020 and capturing roughly 57% of the subscription video-on-demand (SVOD) market. (Showmax comes second with just over 660,000 subscribers.)

Initially, the goal was to test the waters and see where the ripples undulate to. Since it fully launched in Africa, Netflix has invested more in local content and has seen enough potential in the market to encourage deeper exploration. It is buoyed by the varying degrees of success of movies and shows like Atlantics (distribution deal), Citation, Namaste Wahala, Blood & Water, Òlòtūré, and Queen Sono (now cancelled because of COVID).

Last month, it introduced a Mobile Plan across Africa that it had been testing for several months. The plan caters to the continent’s mobile-first audience and feeds into prevalent user behaviour.

Due to the high cost of data and Internet service limitations, people are more likely to download content to their phones before watching. But even downloading content often takes time because Internet speed can be frustrating. So, Netflix is adapting its offerings by creating a mobile-only plan that addresses those problems.

In Nigeria, the plan costs N1,200 (roughly $2.92). In Kenya, it costs KES300. In South Africa, it’s 49 Rand. In other African countries, it will cost the local equivalent of $3.99. The introduction of this plan also indicates Netflix is going punch-for-punch with Showmax (Multichoice’s SVOD property), which also has a mobile plan for that price.

In addition to the new pricing, Netflix has also introduced Partial Play Download (globally). This feature allows users to start watching a video before it’s done downloading. However, it is only available to Android users for now, and they make up over 83% of the mobile operating system market in Africa. In comparison, iOS has just over 14% of the market share.

By all indications, Netflix is going mass-market.

I get Netflix. You get Netflix. We all get Netflix

Netflix needs to grow, and it needs to do so at zero to low marginal cost. It is betting on a future where SVOD is the primary way through which we consume video content. To get there, it needs to be in as many markets as possible. It also genuinely needs to adapt and compete in those markets. This Mobile Plan (or $3 beer) is proof that it’s ready to do whatever it needs to do to grow.

So, Netflix isn’t waiting for people’s pockets to get bigger. Instead, it has figured out what’s in those pockets and aims to get a share of it at a reasonable price. This leads us back to a point I made in Communiqué 09 – to scale a product or service in unfavourable and uncharted terrains, you must meet people where they are. Netflix has studied its users’ behavioural tendencies, and it is adapting to serve them.

Last year, it walked into the bar. This year, it is ready to sit and drink with us. Cheers, everyone!

One more thing…

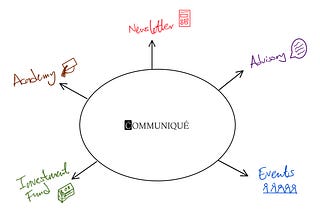

I’ve been writing Communiqué for over a year now, and each edition requires hours (sometimes days and weeks) of research, thinking, writing, editing, and design. So, if you find the insight that I provide valuable, please do me a favour: like the post and share it directly with at least two people you think will love it.

Also, if you like the quality of work that goes into the newsletter, I offer the same quality of writing, research, and consulting services to corporate clients. Reach out to me and let's talk.

PS: As always, thank you to my editor Jane, and my friends Binjo Adeniran, Akachi Ogbonna, and Lanaire Aderemi for helping me edit and refine this essay.

First time reader of your newsletter and it’s the lucidity for me. Definitely moving from “updates” to “inbox”.

Well done!

I love the flow of your articles. It makes me wonder the thought process if it's as smooth too lolz. Please just keep it up. I am glad you now take clients too. This is a lot of quality.